How to Determine Your Initial Investment Portfolio

An investment portfolio is a collection of investments held simultaneously by an entity. It can be an investment company, a financial institution or an individual.

Balancing the combination of investment types in an investment portfolio is a method of minimizing the risk associated with investing. By balancing the portfolio you limit the risk of being left without investment options or earnings should there be a down turn in any particular area of the financial industry. Diversification is key to a “good” investment performance. Diversification means your investment portfolio should consist of stocks, bonds and money market. Stocks can also be diversified according to company and industry.

Determining your initial investment portfolio as an individual investor is straightforward. Given your age and initial investment outlay, you readily can compute how you will allocate your initial capital.

Financial planners and other professionals in the financial industry provide the following guidelines for creating an prospective investor’s initial investment portfolio:

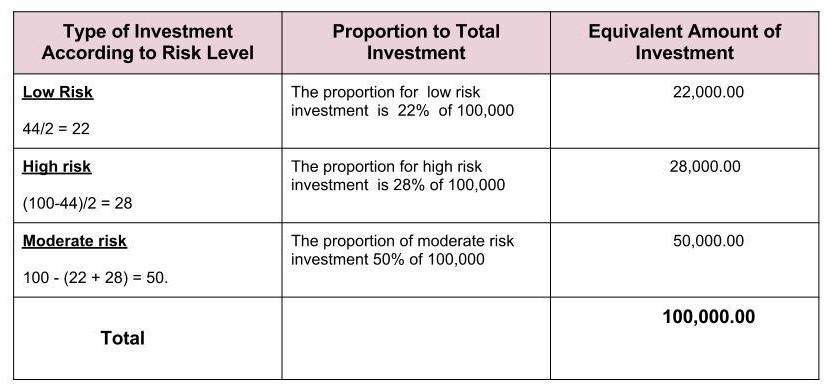

- Invest half your age in low risk investments. In other words, your age divided by two is the proportion you will allocate for low risk investment. Government bonds and treasury bills are considered low risk investment vehicles.

- Subtract your age from 100 and divide it by two. The resulting figure is your allocation for high risk investment. Speculative stocks and foreign exchange are high risk investments.

- Invest the remaining proportion in moderate-risk investment. Mutual funds and blue chip stocks are examples of moderate risk investment

To illustrate: Suppose your age is 44 and you have an investible fund of PhP100,000

The formula implies that the younger you are, the broader is the leeway to go for higher risk investments.

On the other hand, for approaching retirement age should be cautious enough to preserve their retirement fund.

Younger people are inclined to prefer long-term capital appreciation than a steady income stream. Growth stock and high yielding mutual funds are the usual investment vehicle for this purpose.

The guideline however is just for benchmarking purposes. In the final analysis, the investor should be the final judge again depending on

- own financial goals

- time horizon

- risk appetite.

Investing is learning by doing type of endeavor. You get the hang on it if you get started. I had a mentor who used to emphasize: "You will never understand investing, not until you do it".

Once you understand investing, you can now play around with the investment mix in your investment portfolio.