Budgeting worksheets can simplify budgeting your personal finances

A monthly budget has two major components. First is the cash inflow which is your monthly income. The other is your cash outflow which are your monthly expenses.

The monthly income and expense worksheet follows Biblical principles about wealth. It is likewise consistent with the steps to building a solid financial foundation advocated in this site.

Here are the 7 key points applied in following the sequence of the budget worksheet which shall is available at the website of United Church of Magazine article on managing your finances.

- Account for all your sources of income. These can be income from employment (salaries and wages), business income, passive income such as dividends, property rental and other sources not within the earlier categories mentioned.

- Reflect the net income or income net of tax and other deductions in each

cell. Your excel template will total all your entries in the total

column.

- Set aside first, the amount for giving. This includes your tithes and

offerings, charitable obligations. Tithing follows the Biblical

principle of giving back to God a 10th the blessings you received. God

our Creator and the creator of all things. For a better appreciation of

the principle of tithing, read a related article on managing your personal finances. Personally, I

consider tithing as a step of following the biblical principle : Seek ye first

the Kingdom of God and His righteousness and all other things shall be given unto you"

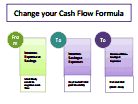

- Savings and Investment should be a priority, not an add-on to your

budget. It is second to tithing in terms of priority. Thus, your cash

flow formula should look like this:

Disposable Income(net of taxes & mandatory deductions) - Tithe - Savings = Disposable Income

- Debt repayment should also form part of your budget. If you have debts with interest rates higher than your investments. You should prioritize debt repayments.

- Emergency fund is also a major item in the budget. Most financial experts would recommend an emergency fund of three to six months of living expenses. But this really depend on your financial situation. Health emergency is the most critical emergency need. Since I have already health care protection, a month emergency fund is sufficient for me.

- The basic living expenses comes last in the budget prioritization

process. "How can we survive?", is the automatic reaction when I share

this principle. There are two necessary ingredients needed to willingly

adopt this principle. One is faith that our Creator gives abundantly

when we follow what he requires. Second is discipline to change our

lifestyle and our attitudes towards money which is reflected in our

spending habits.

To enjoy the budgeting process, allocate some amount for impulses. This

sets a limit to impulse buying. Cultivate a positive attitude towards

budgeting. Consider it as a plan how to spend so you can readily see where your money goes. Good luck to an enjoyable budgeting your personal finances.